Church Trusts

Land & Personal Property

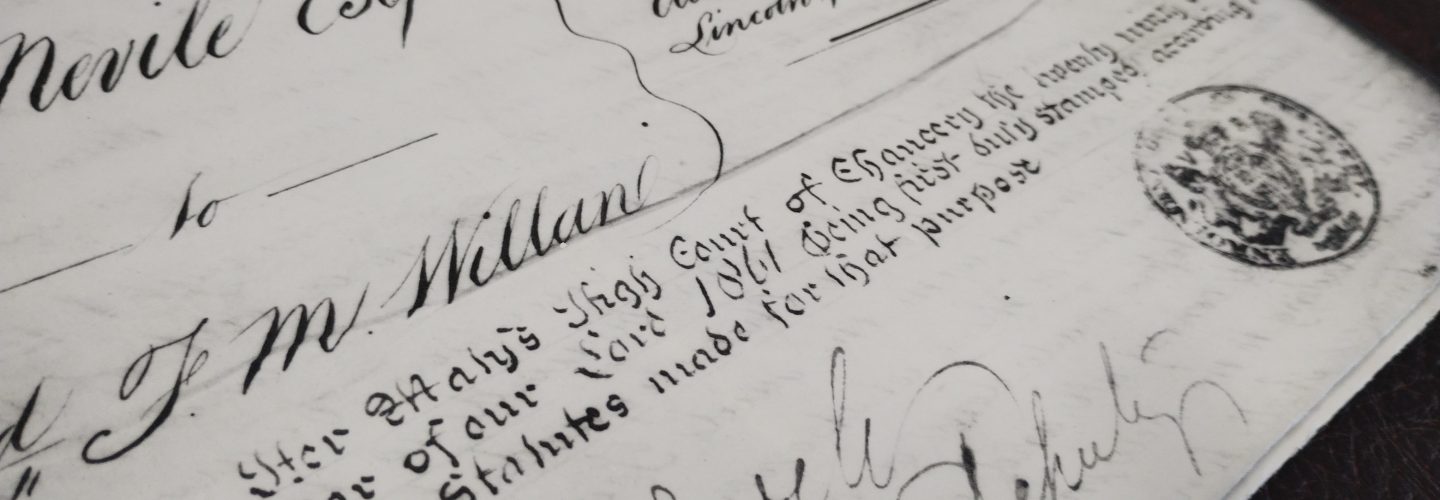

Around 260 Property Trusts and 850 Monetary Trusts are vested in the Lincoln Diocesan Board of Finance (DBF). For these trusts, the DBF acts as Diocesan Authority Custodian Trustee.

For the majority of these Trusts the Parochial Church Council (PCC) or Incumbent & Churchwardens of the parish are the Managing Trustees. This means that they are responsible for the day to day management and control of the Trust affairs and property. However, by virtue of statutory provisions a PCC or Incumbent & Churchwardens may not hold or acquire an interest in Land (other than a short lease) or any interest in personal property to be held as permanent trusts, such interest has to be vested in the Diocesan Authority.

If a PCC intends to acquire a piece of land or property (albeit donated to them or purchased by them), by virtue of the Parochial Church Councils (Powers) Measure 1956, the legal title to the land is required to be vested in the Lincoln Diocesan Trust & Board of Finance Limited. Please contact the Diocesan Assets & Trusts Manager at the outset who will make sure the correct legal procedures are followed.

Similarly, if the PCC proposes to sell or lease church property, the Assets & Trusts Manager should be notified. Selling church property is governed by regulations and requires the prior consent of the Diocesan Trust under the 1956 Measure.

In brief, a suggested procedure for either a lease or sale is as follows:

- The PCC resolves to sell (or let) property

- The PCC approaches Diocesan Trust for consent

- The PCC seeks advice from a surveyor on method of sale (on terms of letting) and obtains a Charities Act Report

- The PCC considers report (or advice) and agrees method of sale.

- The PCC and Diocesan Trust agree the terms of sale or lease.

- The sale or lease is completed.

- The PCC invest or spend the proceeds (depending on the terms)

If your parish is considering a transaction, please make contact with the Assets & Trusts Manager at an early stage. Andrew will help you to follow the proper process.

Monetary Trusts

The monetary trusts administered by the Diocesan Trust on behalf of parishes in the Diocese amounts to over £20 million. These trusts have been set up by bequests, sale of church property and formed by the execution of Letters of Request. The majority of the parish investments held by the Diocese are with CCLA. CCLA are an ethical investment company who provide a range of funds specifically designed for Church of England organisations.

A legacy is a valuable source of funds for a church. A a gift of money left to a church is a pecuniary legacy. Where part of an estate is left to the church after family and friends have been provided for, this is a residuary legacy

Similarly, lifetime gifts or donations can be turned into a Trust Fund by the establishment of a “Letters of Request”. In this way the benefactor requests the Diocesan Trust to become Trustees of the Fund. The Diocesan Trust invests the capital sum and pays the income over to the PCC of the benefactor’s choice. The upkeep of the church, general purposes of the PCC or any other charitable purposes at the benefactor’s discretion, can be paid for with the income.

Please contact Andrew Gosling for further information and guidance.

The Charities Act 2022

Changes to the Rules relating to Permanent Endowments

What is a Permanent Endowment? – Put simply permanent endowment is property that your charity must keep rather than spend.

The Diocesan Trust administers around 850 monetary trust funds, the majority of which are permanent endowments. In a permanent endowment, only the income can be spent and not the capital.

The rules for Permanent Endowment have been relaxed in recent years. The Charities Act 2006 introduced significant flexibility for charities and the Charities Act 2011 extended these powers.

Section 281 of the Charities Act 2011 allows a small charity/Trust Fund to be “wound up”, allowing permanent endowment to be expended.

Conditions – Annual income less than £1,000 per annum. Capital Value less than £10,000. Trustees simply pass a resolution and they are free to spend the permanent endowment as soon as the resolution is passed.

Section 282 of the Charities Act 2011 – If annual income more than £1,000 and capital value greater than £10,000, Trustees pass a resolution although they must seek Charity Commission authority before spending the capital.

The law on Permanent Endowment changed on the 14th June 2013

Under new rules now in force by The Charities Act 2022, Charity Commission consent is determined by one financial threshold based on value (and not the income).

If the capital value of the charity/Trust Fund is less than £25,000, you simply pass a resolution stating that you are satisfied you can achieve the purposes of the fund more effectively by spending the fund itself rather than just spending the income.

However, if the capital value is more than £25,000, the local Trustees will still need to pass a resolution and get the Commissioners authority before spending the capital.

New Borrowing Rules

The new rules introduced by The Charities Act 2022 allow Charity Trustees to borrow from a permanent endowment fund.

Borrowing from your permanent endowment can help you balance your Charities short or long-term needs allowing you to:

- Raise money that your charity needs now

- Keep the benefits of having a lasting Asset.

You can borrow up to 25% of the market value of the fund.

You must:

- Be satisfied that the borrowing is expedient. This means it must bring a clear advantage, rather than just being convenient.

- Repay the borrowed amount within 20 years.

- Set a plan to repay the borrowed amount on time

- Show the borrowing in your Charity Accounts

- Contact the Charity Commissioners if you become unable to meet repayments.

Before you borrow from the permanent endowment funds, you make a formal Resolution and keep a written record and your reasons for borrowing.

If you wish to borrow more than 25% of the value of a permanent endowment fund you must ask for the Charity Commissioners authority.

Replace Purposes of a Charity

It is also possible to replace/modify purposes of a charity by resolution under Section 275 of the Charities Act 2011 if its gross income in its last financial year did not exceed £10,000.

The Trustees only have the power to pass a Resolution if they are satisfied:

- That it is expedient in the interests of the charity for the purposes in question to be replaced, and

- That, so far as is reasonably practicable, the new purposes consist of or include purposes that are similar in character to those that are to be replaced.

Once passed by a majority of not less than 2/3rd of the Charity Trustees, the resolution is passed to the Charity Commission who have 60 days to consider the resolution. If they have no comments and do not object to the proposed amendments the resolution takes effect at the end of the period of 60 days beginning with the date on which the copy of it was received by the Commissioners. The Charity may start to apply its funds for its amended purposes from this date.

For further information or guidance on any of these matters, whether land or money, please contact Andrew Gosling, Assets & Trusts Manager at Edward King House, Minster Yard, Lincoln LN2 1PU andrew.gosling@lincoln.anglican.org (01522 504086)